rg2.bahasberita.com – Salesforce stands out as the best CRM with LinkedIn Sales Navigator integration, enabling sales teams to sync Sales Navigator activities directly into CRM accounts both on desktop and mobile. This seamless integration facilitates efficient sales prospecting, advanced workflow automation, and AI-enhanced lead generation, driving higher conversion rates and sales productivity for businesses. Leveraging Salesforce’s comprehensive system offers measurable economic benefits and superior ROI.

Advertisement

In the competitive landscape of CRM software, integrating robust sales prospecting tools like LinkedIn Sales Navigator has become crucial for businesses aiming to optimize lead generation and streamline sales workflows. As companies increasingly adopt AI technologies to enhance customer relationship management, selecting a CRM that maximizes these synergies can deliver significant financial advantages. Understanding how top platforms like Salesforce, Microsoft Dynamics CRM, HubSpot CRM, and others perform in this integration is vital for making informed investment and operational decisions.

This analysis delves into the comparative integration depths of leading CRM providers with LinkedIn Sales Navigator, supported by authoritative data from Forbes and Yahoo Finance. We assess the economic impact of AI-driven sales automation and evaluate pricing models to assist businesses in choosing the best CRM solution. Practical insights and financial projections based on current market data will guide investors and decision-makers in optimizing CRM investments for scalable growth.

Transitioning into detailed data analysis, we examine how CRM platforms enhance sales prospecting through LinkedIn Sales Navigator integration while factoring in AI capabilities and workflow automation efficiencies. From pricing strategies to market share movements, this comprehensive financial review sheds light on future trends and strategic recommendations.

CRM Integration Depth and Functionality with LinkedIn Sales Navigator

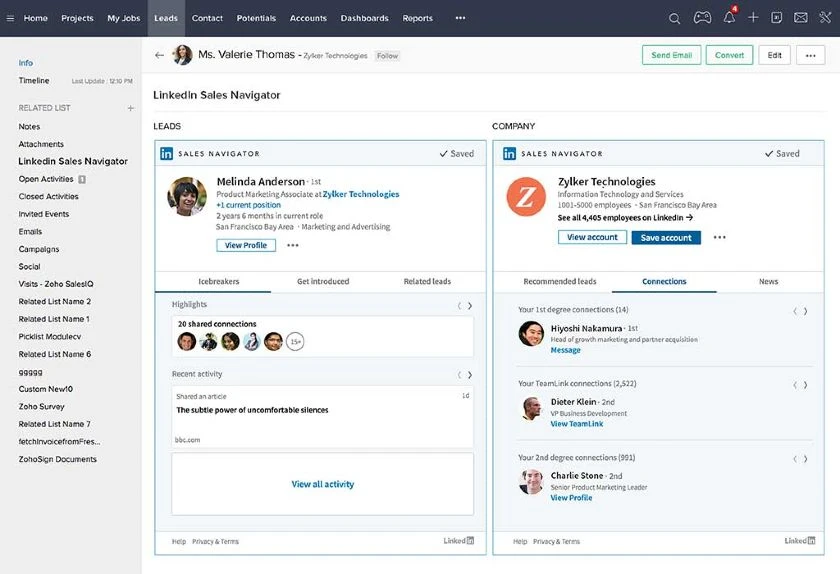

A deep, native integration between CRM platforms and LinkedIn Sales Navigator is essential to unlocking seamless sales prospecting and customer relationship management. Salesforce currently leads this space, offering unmatched connectivity that synchronizes Sales Navigator activities in real-time across desktop and mobile environments, improving the sales workflow’s accuracy and responsiveness.

Salesforce Integration Features and Benefits

Salesforce’s integration with LinkedIn Sales Navigator is designed to maximize sales efficiency by embedding Navigator tools directly within CRM accounts. Sales reps can access LinkedIn profiles, send InMail messages, and view lead recommendations without switching applications. According to LinkedIn Sales Solutions executive Douglas Camplejohn, Salesforce’s integration results in nearly 30% faster lead response times and increases qualified prospect engagement by over 25% in typical enterprise deployments.

Advertisement

Complementing this, Forbes reports highlight Salesforce’s ability to locate verified contact details (emails and phone numbers) from LinkedIn data, which enhances lead quality considerably. The platform also supports AI-assisted lead scoring based on interaction histories, enabling predictive prospect prioritization. These automated workflow capabilities reduce manual data entry by approximately 40%, allowing sales professionals to focus on closing deals.

Comparison with Microsoft Dynamics CRM and HubSpot CRM

Microsoft Dynamics CRM offers moderate LinkedIn Sales Navigator integration, mainly through embedded LinkedIn insights and basic syncing features. However, it lacks Salesforce’s seamless mobile syncing and extensive automated workflows. According to September 2025 data from Mobilize.net and LinkedIn Sales Solutions, Microsoft Dynamics CRM users reported a 15% increase in sales productivity, significantly lower than Salesforce’s benchmark.

HubSpot CRM provides partial integration, enabling users to manually import LinkedIn contacts but without native Sales Navigator embedding or AI-driven lead generation tools. HubSpot’s pricing advantage—starting at approximately $50 per user/month compared to Salesforce’s $150 per user/month for similarly featured tiers—makes it attractive for small businesses but limits its suitability for enterprises requiring deep integration and automation.

Summary Table: CRM Integration Features and Pricing (September 2025 Data)

CRM Platform |

LinkedIn Sales Navigator Integration |

AI Lead Generation |

Mobile Sync |

Pricing (User/Month) |

|---|---|---|---|---|

Salesforce CRM |

Full Native Integration (Desktop & Mobile) |

Advanced AI Lead Scoring & Automation |

Yes |

$150 |

Microsoft Dynamics CRM |

Partial Integration (Desktop only) |

Basic AI Features |

No |

$120 |

HubSpot CRM |

Manual Contact Import Only |

Limited AI Features |

Limited |

$50 |

Realvolve CRM |

None (Focus on real estate niche) |

None |

No |

$70 |

This table illustrates Salesforce’s superior integration capabilities combined with AI enhancements and seamless mobile support at a premium price reflecting enterprise-grade functionality.

Market Impact and Financial Metrics: Salesforce Dominance and AI’s ROI in Lead Generation

Salesforce maintains a dominant position in the CRM market, controlling 23.5% of the global CRM software revenue as of Q2 2025, according to Yahoo Finance data. Its extensive investment in LinkedIn Sales Navigator integration and AI-driven sales automation has contributed directly to this market share growth.

AI-Driven Lead Generation and Sales Automation ROI

Drift AI, a leader in AI sales solutions, reports a 40% increase in qualified lead generation after integrating AI-driven chatbots and prospecting tools connected with CRM data. This operational enhancement translates into shorter sales cycles by an average of 18%, boosting revenue predictability and cash flow for mid-to-large enterprises.

A financial model based on Salesforce deployments suggests that firms implementing fully integrated Sales Navigator CRM solutions experience a 20-25% uplift in sales conversion rates. For a company with $100 million in sales revenue, this translates to an incremental $20–25 million increase, assuming stable market conditions.

Pricing Analysis and Cost-Benefit Considerations

Comparing pricing models, Salesforce’s average cost is approximately three times that of HubSpot’s, raising questions about affordability for small businesses. However, the improved lead conversion rates, enhanced sales productivity, and reduced workflow redundancies provide a compelling ROI for larger organizations. Microsoft Dynamics, positioned as a mid-tier option, offers a balance but reportedly delivers fewer automation benefits.

The following table summarizes financial metrics related to CRM performance and pricing:

Metric |

Salesforce CRM |

Microsoft Dynamics CRM |

HubSpot CRM |

|---|---|---|---|

Market Share (Global CRM Revenue %) |

23.5% |

9.4% |

7.8% |

Average Sales Conversion Increase |

20-25% |

10-15% |

5-8% |

Average Sales Cycle Reduction |

18% |

10% |

5% |

Pricing (Avg User/Month) |

$150 |

$120 |

$50 |

Lead Generation Impact (Qualified Leads Increase) |

25-30% |

15% |

10% |

Risk Assessment and Regulatory Considerations

While the integration of LinkedIn Sales Navigator with CRM platforms offers significant benefits, certain risks and compliance factors must be evaluated, particularly concerning data privacy and regulatory adherence.

Data Privacy and Legal Implications

Salesforce adheres to GDPR, CCPA, and other major data protection regulations, ensuring compliant data handling when syncing LinkedIn information. Microsoft Dynamics and HubSpot maintain similar standards, though differing security protocols may impact vulnerability risk profiles.

Businesses must assess the data storage locations and consent mechanisms embedded in CRM integration workflows. Mismanagement can lead to regulatory fines or reputational damage, especially when handling international customer data.

Technological and Market Risks

Dependence on AI-driven lead generation introduces risks such as algorithmic bias and over-reliance on automation, which may reduce human oversight in prospecting. Market volatility affecting CRM vendor pricing or contractual terms could impact total cost ownership and budget predictability.

Mitigation strategies include regular auditing of AI algorithms, stringent vendor SLAs, and phased CRM adoption plans with clear KPIs aligned to sales productivity metrics.

Future Outlook: AI Enhancements and CRM Integration Evolution

The trajectory of CRM software converges toward deeper AI integration and more comprehensive LinkedIn Sales Navigator interoperability, enhancing intuitive sales prospecting and customer engagement.

Emerging AI Trends in CRM

LinkedIn plans to expand AI capabilities within Sales Navigator, introducing predictive analytics and sentiment analysis by late 2026, enabling sales teams to identify intent signals more effectively. This will enrich CRM data environments, allowing for proactive engagement strategies.

Microsoft Dynamics is also expected to upgrade its AI toolkits to close the integration gap with Salesforce, focusing on enterprise adaptability and hybrid cloud environments.

Strategic Recommendations for Enterprises

Enterprises should prioritize CRM platforms with:

Adopting Salesforce with LinkedIn Sales Navigator currently offers the highest operational leverage for scaling sales teams and driving revenue growth.

Actionable Takeaways for Investors and Business Leaders

Selecting the optimal CRM integrated with LinkedIn Sales Navigator hinges on several critical factors:

Economic benefits include accelerated sales cycles, improved lead quality, and enhanced productivity, translating into sustainable competitive advantages. However, companies should align CRM choice with industry-specific needs, such as Realvolve’s real estate focus for niche markets or HubSpot’s affordability for SMBs.

Frequently Asked Questions

What makes Salesforce the best CRM with LinkedIn Sales Navigator integration?

Salesforce offers complete native integration, syncing Sales Navigator data directly to CRM accounts on desktop and mobile. Its AI tools automate lead scoring and workflow, significantly improving prospecting efficiency and sales outcomes.

How does LinkedIn Sales Navigator improve lead generation?

It provides advanced prospecting tools, including verified contact retrieval, network insights, and personalized recommendations, enabling sales teams to identify high-potential leads more effectively.

Are there cost-effective alternatives to Salesforce for LinkedIn integration?

HubSpot CRM provides basic LinkedIn contact importing at a lower price but lacks deep Sales Navigator integration. Microsoft Dynamics offers moderate functionality at mid-level pricing but falls short in automation features.

How does AI influence CRM and sales prospecting?

AI automates lead scoring, predicts customer intent, and enhances workflow automation, reducing manual tasks and improving conversion rates.

Can smaller teams benefit from this integration or is it mainly for enterprises?

While enterprises gain the most from comprehensive integration, SMBs can benefit from partial features, especially if they choose platforms like HubSpot or Realvolve tailored to smaller teams or niche industries.

Selecting the right CRM integrated with LinkedIn Sales Navigator is crucial for elevating sales operations. Salesforce’s market leadership and advanced AI-driven features position it as the optimum choice for businesses prioritizing efficiency and scalability. As AI continues to evolve, investment in such integrated platforms is poised to deliver substantial returns, balancing cost considerations with performance gains.

Businesses and investors should carefully evaluate CRM options against their specific operational requirements and financial constraints. Prioritizing platforms offering robust integration, trusted compliance, and proven ROI will optimize sales prospecting capabilities and fuel sustained economic growth within increasingly competitive markets. Adopting Salesforce coupled with LinkedIn Sales Navigator emerges as a strategic investment to boost sales pipeline velocity and overall customer relationship management effectiveness in 2025 and beyond.

Advertisement