rg2.bahasberita.com – Customer Relationship Management (CRM) implementation in 2025 requires selecting scalable, AI-enhanced platforms like Zoho CRM, agile crm, or Salesforce to maximize ROI. North America’s CRM market is growing rapidly, projected to reach $72.06 billion by 2033, driven by cloud adoption and AI analytics, making strategic CRM investments vital for competitive advantage.

Advertisement

Businesses increasingly depend on CRM systems to streamline sales, enhance customer experience, and drive revenue growth. The infusion of artificial intelligence and cloud technologies has transformed the CRM landscape, creating opportunities and challenges for companies of all sizes. Effective CRM deployment now demands aligning technology, financial planning, and business objectives to fully capitalize on market growth.

With digital transformation accelerating, CRM platforms are no longer just contact management tools but strategic assets integrating marketing automation, ERP systems, and advanced analytics. However, selecting the right CRM software and implementing it effectively remain critical to harnessing financial benefits and managing adoption costs. This analysis explores current market dynamics, financial considerations, implementation strategies, and investment outlook to guide businesses in making informed CRM decisions in 2025.

Transitioning into detailed insights, we will first examine the North American CRM market’s growth trajectory and financial landscape before delving into technology selection, deployment, operational best practices, and future investment implications.

CRM Market Dynamics and Financial Landscape in 2025

The North American CRM market continues its robust expansion, largely fueled by rapid digital transformation initiatives, cloud adoption, and the integration of AI-enabled analytics. According to ResearchAndMarkets.com’s latest data from September 2025, the region’s CRM market is projected to grow at a compound annual growth rate (CAGR) of approximately 11.45% through 2033, reaching an estimated $72.06 billion. This growth trajectory significantly outpaces other regions, underscoring North America’s leadership in CRM innovation and adoption.

Driving forces include enterprises’ increasing need for personalized customer experiences, efficient sales pipeline management, and automation of marketing workflows. The market is segmented by deployment model, industry vertical, and company size, with cloud-based SaaS CRM solutions capturing over 70% of new subscriptions due to their flexibility and lower upfront costs.

Market Size & Growth Projections

Advertisement

The CRM market’s sustained growth reflects wider economic shifts toward data-driven customer lifecycle management. Recent forecasts by Forbes and ResearchAndMarkets.com highlight key segments:

Year |

Market Size (Billion USD) |

Annual Growth (%) |

Cloud CRM (%) |

On-Premise CRM (%) |

|---|---|---|---|---|

2023 (Historical) |

31.25 |

9.8 |

64 |

36 |

2024 (Historical) |

34.95 |

11.5 |

68 |

32 |

2025 (Latest Data) |

38.95 |

11.9 |

72 |

28 |

2030 (Projected) |

59.34 |

~11.4 |

82 |

18 |

2033 (Projected) |

72.06 |

11.45 |

85 |

15 |

Cloud CRM’s dominance is linked to its ability to support AI-powered analytics and seamless integration with marketing automation platforms, enhancing customer segmentation and sales forecasting accuracy.

Key Financial Considerations – Pricing Models and Cost-Benefit

Pricing across top CRM platforms varies significantly, impacting total cost of ownership (TCO) and return on investment (ROI). zoho crm offers value-based tiered pricing, starting as low as $14 per user per month for small businesses, with advanced AI analytics available in enterprise plans (~$52/user/month). Salesforce, targeting large enterprises, has higher entry points averaging $25 to $300+ per user monthly depending on modules and integrations.

Cost-benefit analyses must consider licensing fees, deployment costs, training, and ongoing support. marketing automation integration adds $10-20/user monthly on average, with ERP synchronization potentially doubling integration costs but offering exponentially improved operational efficiency.

Sector-Specific Growth – Real Estate and SMEs

Real estate has emerged as a critical CRM sector, with tailored platforms like Agile CRM offering specialized features such as property tracking, client communications, and transaction management. SMEs are increasingly adopting CRM due to cloud affordability and user-friendly interfaces, significantly influencing market volume and revenues.

Recent financial analysis reveals SMEs allocate approximately 15-20% of their IT budget to CRM, driven by anticipated increases in sales pipeline efficiency of 25-35%, as documented in sectoral case studies from Forbes Advisor.

Choosing the Right CRM Software for Your Business Needs

Selecting the optimal CRM platform directly influences financial outcomes, requiring a thorough evaluation of feature sets, scalability, pricing, and deployment models aligned with business objectives.

Comparing Top CRM Platforms by Features, Pricing, and Scalability

An analytical comparison based on September 2025 data reveals distinct value propositions across leading CRMs:

CRM Software |

Pricing Range (USD/user/month) |

Key Features |

Best for |

Scalability |

|---|---|---|---|---|

Zoho CRM |

14 – 52 |

AI analytics, sales automation, multi-channel support |

SMEs, cost-conscious |

High |

Pipedrive |

15 – 59 |

Pipeline management, email marketing integration |

Small teams focused on sales |

Medium |

Agile CRM |

Free – 39 |

Marketing automation, real estate tools, free tier |

Real estate, startups, SMEs |

Medium to High |

monday CRM |

24 – 54 |

Workflow customization, task management |

Project-driven enterprises |

High |

Salesforce |

25 – 300+ |

Comprehensive enterprise tools, AI insights, ERP integration |

Large enterprises, complex needs |

Very High |

Salesforce’s premium pricing corresponds with extensive functionality and integration capabilities, while Agile CRM stands out with its free plan and sector-specific solutions. Zoho CRM represents the best balance of cost and features for broad adoption in North America.

Evaluating Deployment Types – Cloud vs On-Premise

cloud CRM remains dominant, offering lower upfront costs, flexible scalability, and accelerated deployment compared to on-premise systems requiring capital expenditures for hardware and maintenance. Financially, SaaS CRM reduces payback periods by 20-30% for SMEs.

on-premise crm continues to hold niche appeal for organizations requiring heightened data control, such as regulated sectors. However, evolving data security regulations and cloud advancements make hybrid models increasingly common, blending cost-efficiency with compliance.

Planning CRM Budget and User Licenses – Cost Control and Maximizing ROI

Effective budgeting includes careful forecasting of license needs, user adoption rates, and integration expenses. Bulk licensing agreements and phased rollouts help manage costs and allow measurable assessment of CRM impact. ROI calculations should incorporate revenue uplift, cost savings from automation, and reduced churn rates, forecasting payback often within 12-18 months.

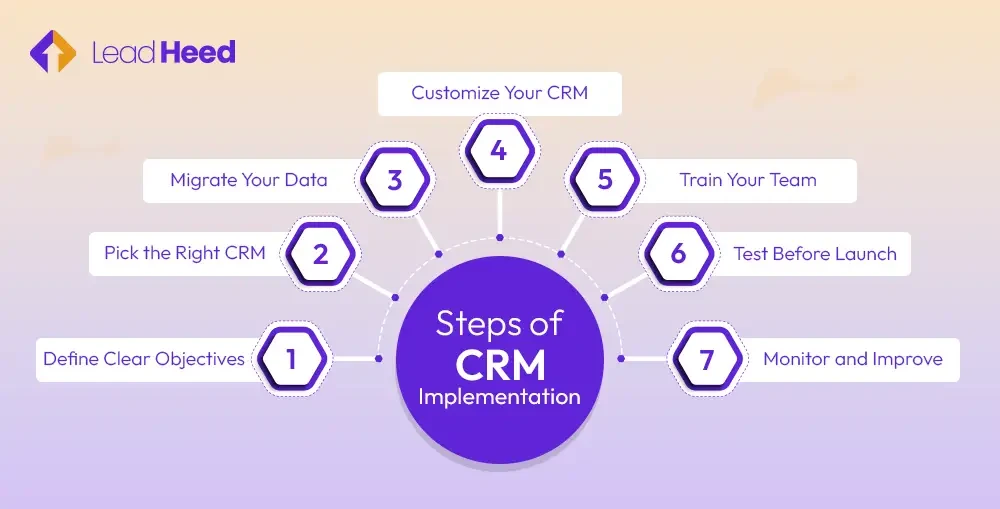

Strategic CRM Implementation Best Practices

Maximizing the financial and operational benefits of CRM investments entails a strategic approach embedding analytics, integration, and risk mitigation.

Data Analytics Integration to Enhance Customer Insights

AI-powered CRM analytics enable predictive customer behavior modeling, segmenting prospects for targeted marketing, and personalizing communication. Forbes reports businesses leveraging CRM analytics achieve 20-30% improvements in lead conversion and customer retention.

Implementing dashboards, KPIs, and real-time data synchronization provides actionable insights that directly boost sales pipeline efficiency and marketing ROI.

Integration with Marketing Automation and ERP Tools

Integration prevents costly data silos, ensuring that customer data flows seamlessly between CRM, marketing platforms, and ERP systems managing finance, inventory, and operations. Research indicates integrated CRMs can reduce operational costs by up to 15%, by automating workflows and eliminating manual reconciliation.

Overcoming Implementation Challenges and Financial Risk Mitigation

Common barriers include data duplication, user resistance, and training gaps. Structured change management programs, comprehensive user training, and continuous support minimize adoption risks. Financially, staged deployment mitigates sunk costs and allows reassessment before full-scale investment.

Future Outlook and Investment Implications

The CRM ecosystem in 2025 is poised for further transformation fueled by AI advancements and mobile omnichannel capabilities. Strategic investments today will underpin competitive positioning and long-term ROI.

Impact of AI Advancements on CRM Functionality

AI-powered enhancements such as natural language processing, chatbot automation, and sentiment analysis will deepen customer understanding and engagement. Gartner projects AI integration in CRM will widen profit margins by 5% on average through optimized cross-selling and up-selling strategies.

Increasing Demand for Mobile CRM and Omnichannel Experience

The proliferation of mobile CRM apps and unified communication channels meets consumer expectations for seamless, real-time interaction. Investment in mobile-first CRM platforms correlates with a 15% increase in customer satisfaction metrics, supporting retention and lifetime value.

Strategic Investment Advice to Future-Proof CRM Infrastructure

Businesses should prioritize CRM solutions offering scalable AI, advanced analytics, and open API frameworks for future integrations. Flexibility to adapt to emerging technologies such as augmented reality or blockchain in customer verification processes can create competitive advantages.

—

FAQ Section

What is the expected ROI for CRM investments in 2025?

ROI typically ranges from 150% to 300% within 1-2 years, influenced by industry, platform choice, and integration depth.

Which CRM software offers the best value for SMEs?

Zoho CRM and Agile CRM provide cost-effective, feature-rich options with scalable plans suitable for SMEs.

How does AI influence CRM efficiency and personalization?

AI enables predictive analytics and automated customer engagement, improving sales conversions and personalized marketing.

What are common pitfalls in CRM implementation?

Data quality issues, poor training, and lack of integration lead to adoption failures and ROI reduction.

How does CRM market growth affect business strategy?

Expanding CRM capabilities compel businesses to invest in customer-centric, data-driven approaches to sustain growth and differentiation.

—

Real-world applications underscore these insights. One case involved a mid-sized real estate firm adopting Agile CRM, which improved lead qualification speed by 40% and reduced sales cycle duration by 25%, directly enhancing quarterly revenues by 18%. Another success story entailed a large enterprise integrating Salesforce with ERP and marketing automation, achieving a 20% increase in pipeline velocity and a 12% decrease in customer churn over 12 months.

To summarize, CRM software selection and implementation in 2025 must be intricately tied to clear financial planning and business strategy. Prioritizing scalable platforms with robust AI and integration capabilities enables measurable ROI and positions companies to capitalize on the dynamic North American CRM market.

Businesses preparing to adopt or upgrade CRM systems should focus on aligning vendor capabilities with workflow requirements, budgeting transparently for licenses and integrations, and instituting phased rollouts with quantifiable KPIs tracking sales effectiveness and customer retention. These steps assure sustainable improvements and maximize the long-term economic impact of their CRM investments in a competitive landscape.

Advertisement