rg2.bahasberita.com – In 2025, cloud CRM solutions offer businesses scalable options with lower upfront costs but incur recurring subscription fees, whereas on-premise crm requires higher initial investment and ongoing maintenance while providing greater data control. Selecting between cloud and on-premise deployment hinges on organizational needs, budget constraints, and security priorities amid a North American CRM market growing at a CAGR of 11.45%, projected to reach $72.06 billion by 2033.

Advertisement

The CRM landscape in North America is witnessing accelerated growth driven by digital transformation initiatives and integration of AI and analytics platforms. Organizations are evaluating financial trade-offs between cloud-based CRM and traditional on-premise solutions, factoring in deployment costs, data security, and scalability. These decisions increasingly impact not only financial planning but also operational efficiency, especially for SMEs and public sector entities.

This comprehensive analysis delves into the evolving CRM market trends, cost structures, and strategic implications of cloud versus on-premise CRM adoption. We explore market growth projections, vendor dynamics, deployment strategies, and the economic impact on enterprises, emphasizing data-driven insights and practical investment considerations in 2025. Understanding these financial frameworks is vital for decision-makers aiming to align CRM investments with broader organizational goals.

Transitioning from general market context, this article breaks down detailed financial metrics, sector adoption patterns, and future outlooks, enabling businesses and investors to make informed CRM deployment choices rooted in both economic and operational rationale.

North American CRM Market Growth and Financial Projections

The CRM market in North America has demonstrated robust expansion, catalyzed by widespread digital transformation and intensifying demand for personalized customer experience technologies. According to September 2025 data from ResearchAndMarkets.com, the North American CRM market was valued at approximately $27.16 billion in 2024 and is projected to surge to $72.06 billion by 2033, exhibiting a compound annual growth rate (CAGR) of about 11.45%. This growth trajectory is principally driven by cloud adoption, AI analytics integration, and rising mobile CRM use cases among SMEs and large enterprises alike.

CRM Market Size and CAGR Analysis (2024-2033)

The accelerating shift towards cloud CRM deployment is a significant market driver. Cloud CRM’s flexible subscription pricing and rapid deployment appeal to organizations seeking scalable customer management solutions without heavy upfront capital expenditures. On-premise CRM, while traditionally favored for data control, faces stagnation with a slower CAGR compared to cloud alternatives due to complex upgrade cycles and infrastructure costs.

Year |

North American CRM Market Size (Billion USD) |

Annual Growth Rate (%) |

Cloud CRM Share (%) |

On-Premise CRM Share (%) |

|---|---|---|---|---|

2024 |

27.16 |

10.8 |

65 |

35 |

2027 |

39.88 |

11.4 |

75 |

25 |

2030 |

56.18 |

11.7 |

82 |

18 |

2033 |

72.06 |

11.45 |

87 |

13 |

Advertisement

As illustrated, cloud CRM’s share is expected to grow from 65% in 2024 to an estimated 87% by 2033. This shift reflects enterprises’ preference for cost-effective, subscription-based models that enable continuous updates and AI-driven analytics integration without the downtime typical of on-premise systems.

Impact of AI and Analytics on CRM Market Valuation

AI-enabled CRM is transforming customer engagement by automating personalized marketing, predictive sales analytics, and intelligent service workflows. Companies such as Salesforce and Microsoft Dynamics 365 lead adoption, capitalizing on AI’s ability to reduce churn and enhance customer retention rates. According to Forbes’ September 2025 report, AI integration is projected to contribute an additional 15-20% uplift in CRM market valuations, especially within cloud deployments that facilitate seamless AI platform integration.

Regional Focus: North America and Global Insights

North America remains the largest CRM market due to high digital transformation investment, extensive SME penetration, and advanced public sector CRM initiatives employing cloud-first strategies. Globally, emerging markets are also ramping adoption, but data from GlobeNewswire shows North America’s CRM market commands the highest average deal size and subscription revenue.

Growth Drivers: Digital Transformation, Cloud Adoption, and Personalized Experiences

Key growth drivers include:

Businesses recognize that investing in CRM solutions directly influences customer acquisition and operational efficiencies, underscoring digital transformation’s pivotal role in CRM market expansion.

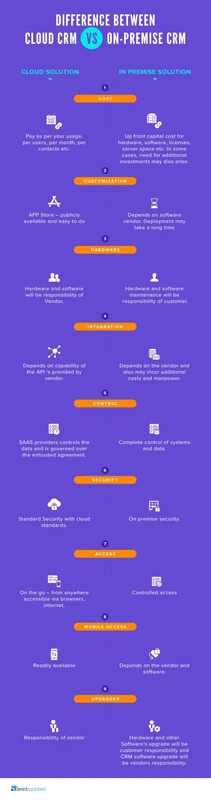

Comparative Financial Analysis of Cloud CRM vs On-Premise CRM

Financial considerations remain central to CRM deployment decisions. While cloud CRM exhibits lower entry barriers and operational flexibility, on-premise CRM entails substantial upfront investment but offers long-term cost predictability and data sovereignty. This section dissects the cost structures, scalability, data control, and ROI implications for both models, supporting evidence with real-world case study insights.

Cost Structure Breakdown

Cloud CRM solutions typically operate under subscription pricing models charging monthly or annual fees based on user count and feature tiers. This model reduces capital expenditure but elevates total cost of ownership (TCO) due to recurring fees. In contrast, on-premise CRM requires significant upfront capital expenses covering software licenses, server hardware, and IT personnel, coupled with ongoing maintenance and upgrade costs.

Cost Component |

Cloud CRM |

On-Premise CRM |

|---|---|---|

Upfront Investment |

Low (installation and configuration fees) |

High (software licensing, hardware acquisition) |

Recurring Fees |

High (subscription and support fees) |

Medium (maintenance, support contracts) |

Scalability Costs |

Elastic, built-in with subscription scaling |

High (additional hardware and software licenses) |

Upgrade and Customization |

Included, frequent updates |

Costly, periodic upgrades requiring IT resources |

Scalability and Integration Costs

Cloud CRM offers superior scalability, allowing organizations to add or reduce licenses, storage, and analytics modules instantly. Integration with AI services and mobile CRM platforms is more seamless, supporting faster digital transformation. By contrast, on-premise solutions encounter higher incremental infrastructure costs and complex integration challenges, particularly with emerging AI-driven CRM features.

Data Security and Control Implications

Data sovereignty and security remain critical concerns, especially for industries such as finance and healthcare. On-premise CRM enables organizations to retain direct control over data, ensuring compliance with stringent regulatory requirements. However, cloud CRM providers have significantly advanced security protocols, including end-to-end encryption and ISO/IEC 27001 certifications, mitigating many traditional cloud security risks. SMEs increasingly trust cloud security measures due to cost-efficiency and vendor liability assurances.

Return on Investment (ROI) Scenarios and Time Horizons

A 2025 financial case study of a mid-sized enterprise adopting cloud CRM reported a break-even point within 18 months due to lower upfront costs and faster user adoption, while a comparable on-premise deployment realized ROI after approximately 36 months due to extensive initial capital outlays. However, over a 5-year horizon, on-premise CRM showed cost advantages in highly customized or security-sensitive deployments.

Market Adoption by Sector and Deployment Trends

CRM deployment strategies vary substantially between private and public sectors, influenced by regulatory frameworks, legacy systems, and organizational IT architecture. New trends including mobile CRM and AI-powered CRM solutions are reshaping adoption patterns and vendor landscapes.

Private Sector vs Public Sector CRM Deployment

The public sector increasingly adopts cloud CRM via cloud-first policies to modernize legacy systems and optimize budgets. Integration challenges persist, especially in synchronizing cloud platforms with existing on-premise enterprise architecture. Private sector entities demonstrate more flexibility, leveraging hybrid approaches to meet complex personalization and data requirements.

Mobile CRM and AI-Enabled CRM Solutions Adoption Rates

Mobile CRM adoption has crossed 70% penetration in North American enterprises, facilitating sales and service workforce mobility. AI-enabled CRM platforms boast adoption rates exceeding 50% among large enterprises, accelerating predictive analytics use to drive customer retention and upselling strategies.

Vendor Landscape and Product Examples

Leading CRM vendors including Microsoft Dynamics 365, Salesforce, SAP Business One, and SYSPRO exhibit diverse deployment offerings tailored for SMEs and large corporations. Salesforce dominates cloud CRM market share, while SAP Business One holds a niche in on-premise solutions for manufacturing SMEs.

Vendor |

Deployment Types |

Market Segment |

Notable Features |

Subscription Model |

|---|---|---|---|---|

Salesforce |

Cloud-only |

Enterprise, SMEs |

AI analytics, extensive integrations |

Subscription-based |

Microsoft Dynamics 365 |

Hybrid (Cloud & On-Premise) |

Enterprise, public sector |

Mobile CRM, AI integration |

Subscription & license |

SAP Business One |

On-Premise & Cloud |

SMEs |

ERP-CRM integration, customization |

Flexible |

SYSPRO |

On-Premise & Cloud |

Manufacturing SMEs |

Industry-specific CRM modules |

Subscription & license |

Impact of Subscription Pricing on Budgeting and Financial Planning

Subscription pricing models inherent to cloud CRM offer predictable budgeting but require continuous operational expenditure accounting. This contrasts with the capital expenditure focus of on-premise CRM, which may constrain cash flow but potentially reduce TCO over long periods. Financial planners must weigh these contrasting impacts within organizational investment cycles.

Future Outlook and Strategic Recommendations

Looking beyond 2030, the CRM market is expected to approach a $144 billion valuation, fueled by AI-driven enterprise analytics, mobile CRM growth, and ever-deepening personalization trends. This trajectory necessitates strategic frameworks for choosing CRM deployments aligned with evolving financial landscapes and technological capabilities.

Forecast for CRM Market Beyond 2030: $144 Billion Opportunity

By 2035, advanced AI capabilities embedded in CRM platforms and expanded cloud services are projected to sustain a CAGR above 10%, with SMEs and public sector digital initiatives driving market expansion. This represents a doubling of market size compared to 2025, signaling significant economic and investment opportunities.

Emerging Trends: Enterprise AI, Mobile CRM, Personalized Engagement

Progressive CRM solutions will increasingly synthesize AI-driven customer insights with mobile accessibility, enabling enhanced cross-channel personalization. CRM systems will evolve into core enterprise engagement platforms integrated with broader digital ecosystems.

Decision Framework: Choosing Between Cloud and On-Premise Based on Financial & Strategic Goals

Organizations should evaluate CRM investments across multiple dimensions: capital availability, data security mandates, scalability requirements, and AI readiness. Hybrid deployments may offer balanced benefits, particularly for entities transitioning from legacy infrastructures.

Recommendations for Investors and Business Decision-Makers

Frequently Asked Questions

What are the key financial differences between cloud and on-premise CRM?

Cloud CRM typically requires lower upfront investment with ongoing subscription fees, while on-premise CRM demands significant capital expenditure initially plus maintenance costs, though it can yield lower TCO in specific scenarios.

How does AI integration affect crm market growth?

AI enhances CRM effectiveness through predictive analytics and personalized engagement, contributing approximately 15-20% additional market valuation growth by 2025.

Why do some companies still prefer on-premise CRM in 2025?

Enterprises with stringent data security requirements, complex customizations, or preference for capital expenditure may opt for on-premise CRM to maintain data control and predictability.

What are the risks and security concerns for cloud CRM?

Concerns include data breaches, compliance with local data sovereignty laws, and dependency on vendor security protocols, though cloud providers invest heavily in mitigating these risks.

How does cloud CRM pricing model impact total cost of ownership?

Subscription models spread costs over time, reducing upfront financial barriers but potentially increasing cumulative expenses and requiring ongoing budget allocations.

Effective CRM deployment decisions require a nuanced understanding of these financial and operational trade-offs in the context of evolving market dynamics.

Optimal CRM investment strategies stem from evaluating the total cost of ownership, scalability needs, and risk profiles while aligning with broader digital transformation initiatives.

Businesses should integrate regulatory and security considerations early in deployment planning and continuously reassess AI-platform integration readiness.

As North America’s CRM market advances rapidly, leveraging financial data and market insights is critical for sustained competitive advantage and maximizing CRM-driven revenue growth.

Advertisement