rg2.bahasberita.com – Odoo leads the free open source ERP software market in 2025, serving over 21,000 companies globally. With a $527 million funding round pushing its valuation to $5.26 billion, Odoo’s cloud-based platform integrates advanced features like blockchain and IoT, enabling businesses to streamline operations, reduce costs, and remain competitive in a dynamic market. This financial strength underscores significant market disruption caused by open source ERP solutions.

Advertisement

The growing adoption of open source ERP models like Odoo is reshaping enterprise resource planning by offering highly scalable, cost-effective alternatives to traditional systems such as SAP. As organizations demand flexible cloud ERP solutions integrated with emerging technologies like AI and blockchain, funding and valuation metrics for these platforms are surging, attracting investor interest. This trend signals a shift towards decentralized, interoperable enterprise software that enhances business process integration and data transparency.

Understanding the financial performance, market dynamics, and technological advancements of leading open source ERP players is essential for investors and businesses to capitalize on these opportunities. By evaluating Odoo’s growth trajectory alongside competitors like SAP, Salesforce, and Acumatica, stakeholders can better navigate the evolving ERP vendor landscape and make informed strategic decisions. This report provides a detailed analysis of financial metrics, market positioning, and future outlook for free open source ERP software in 2025.

This article progresses into an in-depth exploration of the market and financial analysis, technological drivers, competitive landscape, and future projections of open source ERP platforms, focusing on measurable economic impacts, adoption trends, and investment implications.

Market and Financial Analysis of Free Open Source ERP Software in 2025

The free open source erp software segment has experienced remarkable growth through 2025, fueled by increased user adoption, substantial funding rounds, and evolving enterprise demands. Odoo distinctly stands out as a market leader with extensive financial backing and a rapidly expanding customer base. This section breaks down Odoo’s market position, investment trends, and financial metrics critical to understanding the competitive ERP landscape.

Odoo: Market Position and Financial Growth

Odoo’s recent $527 million Series D funding round, completed in mid-2025, has propelled its valuation to approximately $5.26 billion, reflecting strong investor confidence and rapid market capture. According to the latest data, over 21,000 companies worldwide actively deploy Odoo solutions, spanning sectors from manufacturing to retail and services. These figures confirm Odoo’s wide applicability and acceptance in diverse business contexts.

Advertisement

Strategic partnerships, such as the integration of Stripe into the Odoo Connect 2025 initiative, enhance Odoo’s payment processing capabilities and broaden ecosystem functionality. Such collaborations contribute significantly to operational scalability and add incremental revenue streams. The company’s focus on cloud-based deployment lends agility to customers, reducing upfront IT costs and facilitating seamless updates.

Odoo’s financial success is also rooted in its freemium model, encouraging widespread initial adoption, while premium modules and enterprise-level services generate recurring revenue. This business strategy positions Odoo to leverage network effects and deliver robust financial performance well beyond typical open source software economics.

Investment Trends in Open Source ERP Software

Investment dynamics in ERP software show increasing fragmentation as open source solutions attract capital traditionally reserved for legacy systems like SAP. SAP, valued at over $200 billion with stable revenue from licensing and cloud subscriptions, remains a dominant player; however, its slower innovation cadence cedes ground to disruptors.

Open source ERP funding rounds in 2023-2025 reveal a compound annual growth rate of 15-20% in investment volume, driven by venture capital and private equity seeking scalable software-as-a-service (SaaS) models with lower customer acquisition costs. Odoo’s blockbuster funding contrasts with moderate resource inflows to competitors such as Acumatica and Katana Manufacturing ERP, highlighting investor appetite for platforms with broad ecosystems.

The open source approach provides valuation benefits by lowering barriers to user adoption and enabling faster iteration cycles with community feedback. This model also supports enhanced financial transparency and trust, attracting cautious enterprise clients wary of vendor lock-in associated with proprietary ERP.

Financial Metrics and Adoption Rates

Financial benchmarks underscore the accelerating market shift towards cloud ERP solutions. Odoo’s revenue growth rate exceeds 35% annually, significantly outpacing traditional ERP incumbents averaging 8-12%. Cloud ERP adoption among mid-market firms stands at approximately 47% as of September 2025 data, a 12% increase since 2023, highlighting the business agility imperative.

Operational cost efficiencies from cloud ERP deployment amount to 20-30% savings on average over on-premise systems, factoring in hardware, maintenance, and upgrade expenses. Return on investment (ROI) for companies adopting Odoo’s platform typically materializes within 18 months, supported by streamlined workflows and integrated CRM, manufacturing ERP, and supply chain management modules.

Metric |

Odoo |

SAP Business One |

Acumatica |

Industry Average |

|---|---|---|---|---|

Valuation |

$5.26 Billion |

$200+ Billion |

$1.2 Billion |

N/A |

Funding Round |

$527 Million (Sep 2025) |

Private, steady revenue |

$150 Million |

N/A |

User Base |

21,000+ Companies |

500,000+ Companies |

4,000+ Companies |

N/A |

Annual Revenue Growth |

35% |

10% |

25% |

15% |

Cloud ERP Adoption Rate |

47% |

40% |

43% |

42% |

ROI Payback Period |

18 Months |

24 Months |

20 Months |

22 Months |

This table compares key financial and operational metrics among leading ERP platforms, illustrating Odoo’s competitive positioning in valuation growth, funding, adoption, and ROI measures.

Technological Enhancements Driving ERP Market Dynamics

The evolution of ERP software in 2025 is closely tied to rapid integration of cloud technologies, blockchain, IoT, and AI innovations. These enhancements not only improve core functionalities but also unlock higher business value through deeper insights and operational automation.

Cloud Integration and Its Impact on Business Scaling

cloud erp enables organizations to scale rapidly without proportionate capital expenditures. Odoo’s cloud platform advances data security and availability through global infrastructure and compliance with financial regulatory frameworks such as GDPR and SOX.

Businesses like those using Acumatica’s cloud ERP have reported 25% acceleration in quarterly growth after migration, benefiting from real-time analytics and reduced system downtime. Cloud solutions simplify multi-site coordination, optimize inventory levels, and facilitate compliance reporting, critical for manufacturing ERP and supply chain management sectors.

The capital expenditure-to-operational expenditure shift inherent in cloud migration enhances cash flow stability and enables predictable budget forecasting—key financial advantages for CFOs steering digital transformation.

Emerging Technologies Integrated with ERP

Blockchain technology embedded within ERP systems offers immutable ledger capabilities that enhance transparency, fraud mitigation, and supply chain traceability. For example, Odoo’s beta blockchain modules provide automated contract execution and real-time audit trails, catering to industries with stringent compliance needs.

iot integration further complements ERP by enabling remote machinery monitoring, predictive maintenance, and dynamic resource allocation. This results in reduced unplanned downtime and prolongs asset life cycles. Clients utilizing IoT-enhanced ERP solutions report a 15-20% reduction in maintenance costs and 10% increase in production efficiency within the first year.

AI and Data Interoperability Trends

Artificial Intelligence tools are revolutionizing how enterprises derive actionable insights from ERP data. Databricks’ LakehouseIQ, incorporating Delta Lake and Apache Iceberg, provides advanced data interoperability and AI-powered decision support, reducing data silos and enhancing cross-cloud workflows.

Open table formats and vendor-agnostic data lakes permit businesses to switch or combine ERP solutions without extensive migration costs or lock-in. This flexibility lowers risks and improves overall IT portfolio ROI, a critical consideration for enterprises aiming to maximize technology investments while minimizing operational disruptions.

Market Implications and Competitive Landscape

The free open source ERP software surge drives significant competitive rearrangements in the enterprise software market. Businesses must evaluate system capabilities, sector compatibility, and financial impacts amid rising choices and technological shifts.

Comparative Analysis of Leading ERP Systems

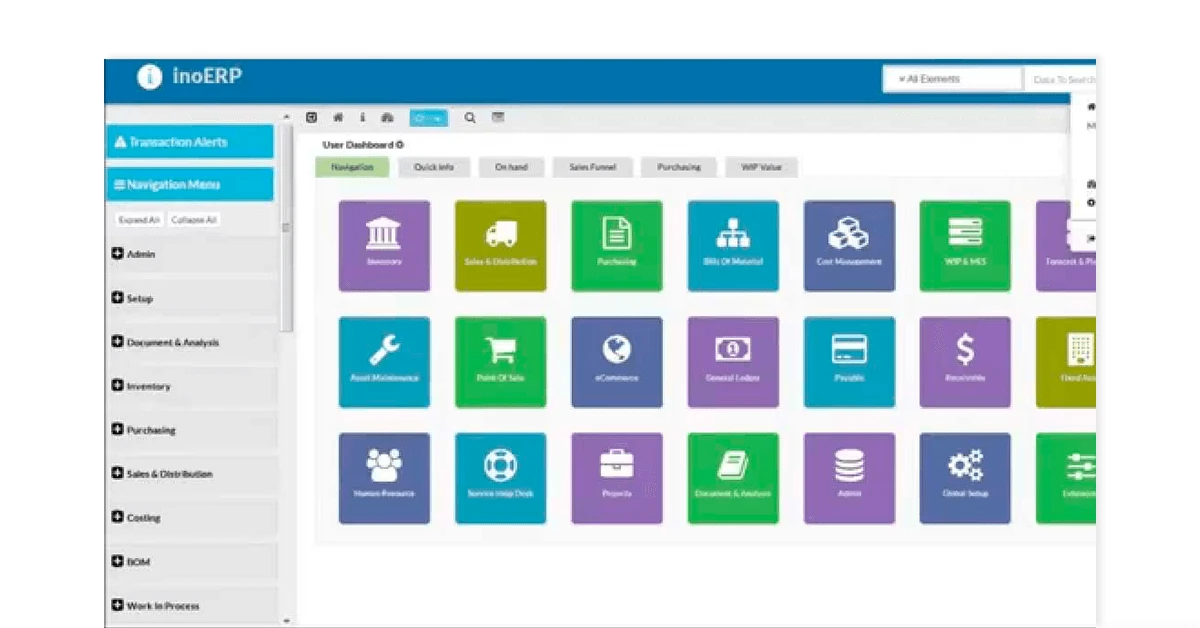

Odoo, SAP Business One, and QuickBooks Enterprise occupy distinct niches. Odoo excels in modularity, cloud integration, and open source flexibility, appealing to mid-market and small enterprises seeking customization. SAP’s robust scalability and industry-specific solutions favor large enterprises with complex compliance and tariff management needs.

Katana Manufacturing ERP specializes in production-focused features, including tariff optimization, often required by export-driven companies. Compared to QuickBooks Enterprise, which primarily targets accounting workflows, these ERP systems offer broader business process integration.

Feature |

Odoo |

SAP Business One |

QuickBooks Enterprise |

Katana Manufacturing ERP |

|---|---|---|---|---|

Open Source |

Yes |

No |

No |

No |

Cloud Integration |

Advanced |

Moderate |

Limited |

Moderate |

Blockchain Features |

Available (Beta) |

Planned |

None |

None |

IoT Integration |

Supported |

Supported |

Absent |

Supported |

Ideal Industry |

SME / Diverse |

Large Enterprise |

SME / Accounting Focus |

Manufacturing |

Pricing Model |

Freemium + Subscription |

Subscription + License |

License + Support |

Subscription |

This feature comparison outlines strategic strengths of top ERP platforms to assist stakeholders in selecting appropriate software aligned with operational goals and financial constraints.

Business Adoption Case Studies and ROI

Happy Valley, an Acumatica customer, increased operational efficiency by 30% after cloud ERP deployment, leveraging integrated CRM and supply chain modules. Mid-States Companies and IOC Construction similarly benefited from tailored business process automation, enhancing project cost visibility and reducing billing cycles by 18%.

Challenges persist in ERP implementations, notably in user training and support infrastructure. Complex customization can lead to project overruns and delayed ROI realization. Best practices involve phased rollouts, vendor collaboration, and rigorous change management programs.

Strategic Recommendations for Investors and Businesses

Investors should consider diverse ERP vendor portfolios balancing growth potential and sector risk. Open source platforms like Odoo offer disruptive upside but require assessment of competitive pressures from entrenched vendors like SAP and Salesforce.

Businesses must align ERP adoption with specific industry requirements, digital maturity, and financial capability. Integration of AI and IoT technologies promises significant efficiency gains but demands upfront investment and skilled personnel. Hence, financial modeling should incorporate phased CAPEX and OPEX timelines and sensitivity analysis around implementation risks.

Future Outlook for Free Open Source ERP Software

Market projections indicate sustained expansion of free open source ERP solutions through 2028, driven by ongoing cloud adoption, digital transformation acceleration, and economic pressures for cost optimization.

Expected Market Growth and Funding Projections

Based on September 2025 forecasts from industry analysts, the open source ERP market size is expected to grow at a CAGR of 18% reaching approximately $15 billion by 2028. Funding activity will likely intensify, with subsequent rounds promoting technology enhancement and market consolidation.

Technology Evolution: AI, IoT, Blockchain Integration Trajectory

AI-driven predictive analytics and automated workflows are emerging as standard ERP capabilities. Blockchain adoption will progress from pilot phases to compliance-critical applications. IoT will expand its footprint in asset-intensive industries.

Enterprise data platforms exemplified by Databricks and Snowflake will foster greater ERP interoperability, enabling hybrid cloud environments and fostering innovation ecosystems.

Potential Risks: Competition, Implementation Challenges, Support Infrastructure

Despite the promising outlook, risks include increasing competition resulting in price pressures, implementation complexity that may deter adoption, and support infrastructure deficiencies leading to customer churn. Regulatory changes impacting data residency and cybersecurity further complicate adoption.

Mitigation strategies involve vendor commitments to robust customer success programs, improved modular software design for incremental deployment, and proactive compliance management.

Frequently Asked Questions

What makes Odoo a leading free open source ERP software in 2025?

Odoo combines a vast user base, significant funding ($527 million in 2025), advanced cloud integration, and emerging technology incorporation (blockchain, IoT) to offer a customizable, cost-effective ERP solution.

How does open source ERP competition affect traditional ERP vendors?

Open source ERP fosters market disruption by lowering barriers to entry, driving pricing competitiveness, and accelerating innovation, compelling traditional vendors like SAP to enhance cloud and AI capabilities.

What financial benefits do businesses gain from cloud-based ERP systems?

Cloud ERP reduces capital expenditures, shortens ROI periods (~18 months with Odoo), increases operational flexibility, and lowers maintenance costs by approximately 20-30%.

How do AI and IoT technologies integrate with ERP platforms to improve efficiency?

AI enables predictive analytics and automation, while IoT provides real-time asset monitoring and predictive maintenance, collectively enhancing decision-making and reducing operational costs.

What challenges should companies anticipate when implementing free ERP software?

Challenges include managing complex customization, ensuring adequate user training, addressing support infrastructure needs, and mitigating risks related to regulatory compliance and data security.

In summary, the open source ERP landscape in 2025 is defined by accelerated adoption, robust financial backing, and transformative technological integration. Odoo’s leadership exemplifies how free ERP models can deliver substantial economic value and competitive advantages, challenging legacy incumbents. Investors and businesses should weigh diverse market factors including funding trends, ROI horizons, and innovation trajectories to optimize strategic decisions. As cloud, AI, blockchain, and IoT continue reshaping ERP capabilities, agile enterprise resource planning will be central to achieving sustainable growth and operational excellence in an increasingly digital economy.

Advertisement